Personal Credit

We’re here to tell you about

We’re here to tell you about

- WHAT is CREDIT?

- HOW is YOUR credit score calculated?

- CAN YOU actually improve your score?

- Can you LOWER your monthly payments?

- HOW can I qualify for a MORTGAGE?

- HOW do I IMPROVE MY CREDIT?

What IS Credit?

The ability to obtain goods or services before payment, based on the trust that payment will be made in the future: “unlimited credit”.

Are you credit worthy? Everything is reduced to a mere number – YOUR CREDIT SCORE!

Why CARE about your FICO score?

Whether you’re buying a home, a car or applying for a credit card – lenders want to know the risk they’re taking by lending your money.

FICO scores are the credit scores that most lenders use to determine your credit risk.

Your FICO credit scores (you have 1 score from each of the 3 major credit bureaus) can affect how much money a lender will lend you and at what terms (interest rate).

So, taking steps to improve your FICO scores can often help you qualify for better rates from lenders.

How Do We Help?

Information in Credit Reports must be:

- 2.9 Billion pieces of information are transferred monthly.

Did you know?

79% of that data is INACCURATE!

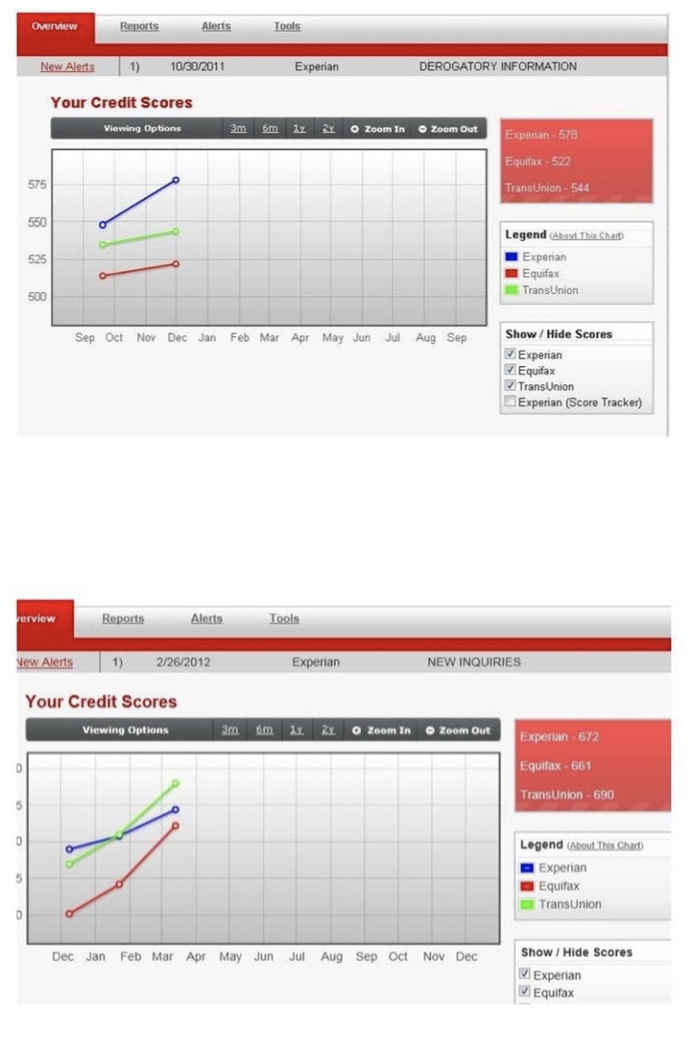

EQUIFAX – 15 POINTS

EQUIFAX – 15 POINTS

TRANSUNION – 14 POINTS

EXPERIAN – 30 POINTS

59 point gain – 1 month!

EQUIFAX – 161 POINTS

TRANSUNION – 111 POINTS

EXPERIAN – 22 POINTS

294 point gain – 4 month!

There is HOPE…

Let us help you make your dreams come true.

Newsletter Sign Up

NO OBLIGATION Consultation!

Contact Info

Allison (Bennett) Browne

Business / Personal Credit and Funding Advisor

- 1997 Annapolis Exchange Parkway, Suite 300 Annapolis, Maryland 21401

- Direct: 202-787-9682

- Office: 844-572-7100 x 101

- Fax: 301-358-6548

- info@bwealthyb.com